Many people who live in Maryland work in other states, and many people who live in other states maintain employment here in Maryland. This is true of full-time, part-time, and self-employed individuals, and it's especially common for residents of the greater Baltimore area. Living and working in two different areas can make things a bit tricky during tax season, so we want to clear up any confusion and make things as simple as possible for you when it comes time to file your returns this spring.

A computer survey of 16 selected states with both state income taxes and casino or pari-mutuel gambling found that 15 impose state income taxes on nonresidents ' winnings in those states. Of the states surveyed, only New York follows Connecticut ' s example in excluding nonresident casino and pari-mutuel winnings from its state income tax. MARYLAND Maryland and on all gambling winnings derived from Maryland IF YOU ARE A: NONRESIDENT INCOME TAX FORM RETURN INSTRUCTIONS 505 DUE DATE. Your return is due by April 15, 2020. If you are a fiscal year taxpayer, see Instruction 26. If any due date falls on a Saturday, Sunday or legal holiday, the return must be filed by the next business.

Keep reading to learn more about nonresident returns, including when you're required to file a nonresident return and even some instances where people who live and work in different states are not required to file a nonresident return. And, as always, if you have any questions about your filing status or other issues, please reach out to our team at S.H. Block Tax Services for help.

Who Needs to File a Nonresident Tax Return?

Individuals who have earned money in a state other than the one in which they permanently reside generally must file a nonresident state tax return. For instance, if you live in Maryland but work in Wilmington, you'll need to file a nonresident return in Delaware.

Additionally, you might have to file a nonresident return if your employer mistakenly withheld taxes for the wrong state and you want to receive your refund from that state. You will likely also have to file a nonresident return if you received non-employment income in a state other than the one in which you reside.

Non-Employment Income Taxes for Nonresidents

Taxpayers who earn or receive income from out of state must file nonresident returns in addition to tax returns in their home state. Don't worry, though — you won't be forced to pay income taxes more than once. Sometimes, even if you don't perform your job functions in another state, you might have to file income in one since most states tax all income sourced to their state.

Here are a few examples where you would likely need to file a nonresident income tax return:

A computer survey of 16 selected states with both state income taxes and casino or pari-mutuel gambling found that 15 impose state income taxes on nonresidents ' winnings in those states. Of the states surveyed, only New York follows Connecticut ' s example in excluding nonresident casino and pari-mutuel winnings from its state income tax. MARYLAND Maryland and on all gambling winnings derived from Maryland IF YOU ARE A: NONRESIDENT INCOME TAX FORM RETURN INSTRUCTIONS 505 DUE DATE. Your return is due by April 15, 2020. If you are a fiscal year taxpayer, see Instruction 26. If any due date falls on a Saturday, Sunday or legal holiday, the return must be filed by the next business.

Keep reading to learn more about nonresident returns, including when you're required to file a nonresident return and even some instances where people who live and work in different states are not required to file a nonresident return. And, as always, if you have any questions about your filing status or other issues, please reach out to our team at S.H. Block Tax Services for help.

Who Needs to File a Nonresident Tax Return?

Individuals who have earned money in a state other than the one in which they permanently reside generally must file a nonresident state tax return. For instance, if you live in Maryland but work in Wilmington, you'll need to file a nonresident return in Delaware.

Additionally, you might have to file a nonresident return if your employer mistakenly withheld taxes for the wrong state and you want to receive your refund from that state. You will likely also have to file a nonresident return if you received non-employment income in a state other than the one in which you reside.

Non-Employment Income Taxes for Nonresidents

Taxpayers who earn or receive income from out of state must file nonresident returns in addition to tax returns in their home state. Don't worry, though — you won't be forced to pay income taxes more than once. Sometimes, even if you don't perform your job functions in another state, you might have to file income in one since most states tax all income sourced to their state.

Here are a few examples where you would likely need to file a nonresident income tax return:

Maryland State Tax On Gambling Winnings Gambling

- Business partnerships: If you earn income as a partner in an LLC, S-corporation, or another type of verified business partnership based in a state other than the one in which you reside, that income is likely taxable in the state(s) in which the partnership exists.

- Out-of-state services: Individuals who frequently travel to a neighboring state to perform services (e.g., a plumber crossing state lines to fix piping issues) must complete a nonresident return.

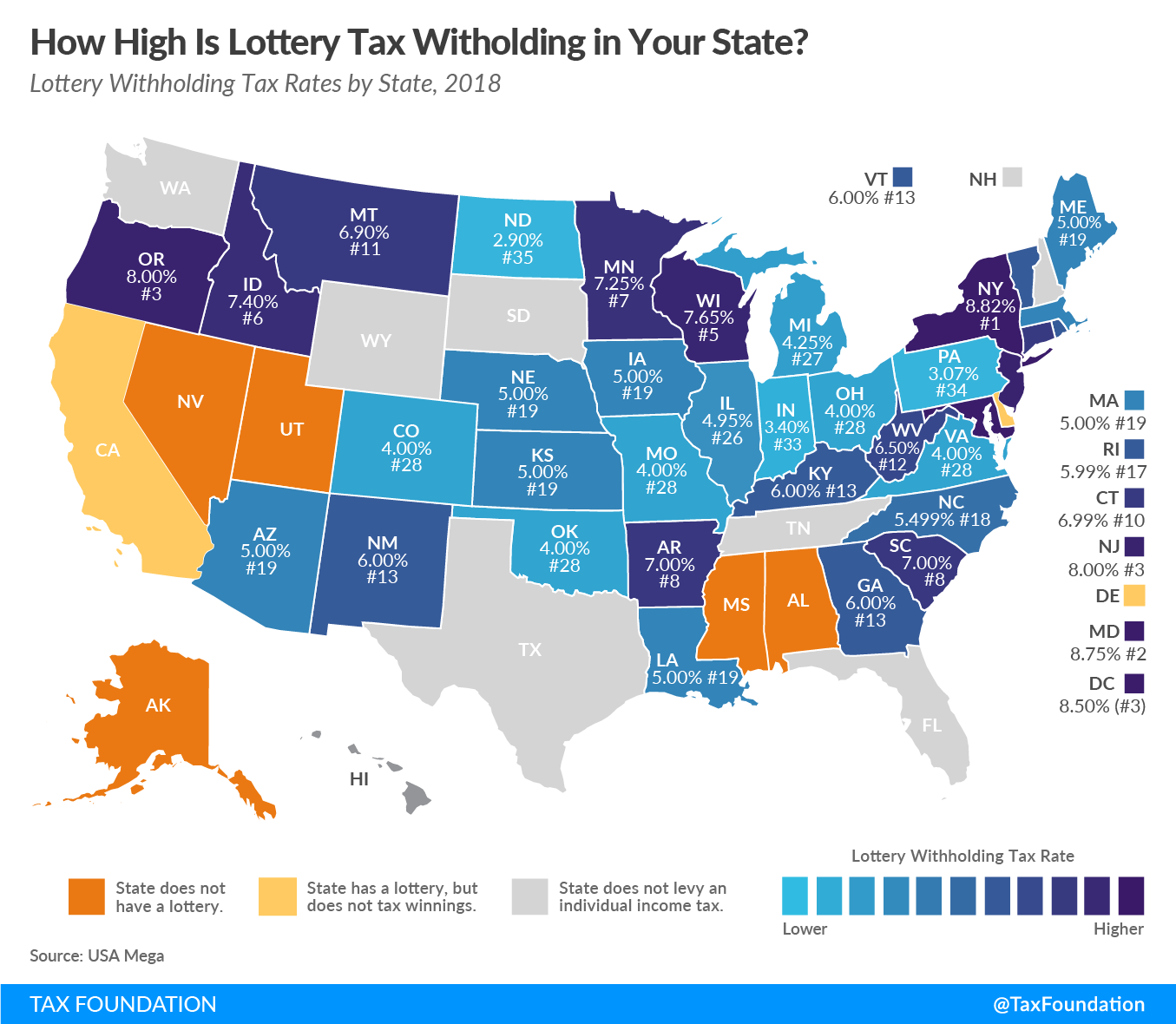

- Gambling profits: Taxpayers who make more than $5,000 from out-of-state gambling winnings or by playing another state's lottery are subject to nonresident income taxes.

- Property income: If you've sold a piece of property or you collect rent for a property in a state other than the one in which you reside, you'll have to complete a nonresident income tax return.

What Is a Reciprocal State?

Winstar world casino steakhouse. Reciprocal states have agreements with neighboring states that allow individuals to work there without having to file a nonresident return. Many states have created these arrangements because they have major urban areas close to their borders. For example, employees who live in Bethesda but work in Washington D.C. are usually not required to file a nonresident income tax return (although they might still have to file a nonresident return if they have non-employment income from D.C. or if they had taxes withheld there). There are a few other exceptions to reciprocal state agreements, so please contact an experienced tax resolution representative if you want to know more.

As of 2018, 15 states have reciprocal agreements with one or more of their neighbors. These states include:

- Arizona

- Illinois

- Indiana

- Iowa

- Kentucky

- Maryland

- Michigan

- Minnesota

- Montana

- North Dakota

- Ohio

- Pennsylvania (ended agreement with New Jersey in 2016)

- Virginia

- West Virginia

- Wisconsin

- District of Columbia (agreements with Maryland and Virginia)

Maryland State Tax On Gambling Winnings Rules

Contact S.H. Block Tax Services to Learn More

Maryland State Tax On Gambling Winnings 2020

As a firm operating in Baltimore, where interstate work commutes are common, we have extensive experience dealing with nonresident tax returns and other complex tax filing issues. Poker equity definition. We've also handled a wide range of other tax liability issues for our clients, and we've helped thousands resolve their tax debt, re-enter compliance with the IRS and the State of Maryland, and forge a path back to financial freedom.

Maryland State Tax On Gambling Winnings Winning

If you would like to schedule a free consultation to discuss your personal or business tax issues or ask any filing questions, please contact S.H. Block Tax Services today by calling (410) 793-1231 or completing this brief form. Our firm has achieved an A+ rating with the Better Business Bureau, and our attorneys and helpful support staff are ready to get to work on your behalf.